Best options for investing in the large cap space

Large cap or Bluechip funds offer good returns with relatively lower drawdowns in the equity space. For example, Nifty 50 has provided an annualized return of about 12% over the last 5 years (with a maximum drawdown of about 38% during the Covid induced crash). These should be an essential part of one’s portfolio.

But how does one go about picking the right mutual fund to invest in this space? In our perspective, it has to be a fund that CONSISTENTLY beats the performance of the large cap index (typically NIFTY 50 or NIFTY 100 are used for comparison). And ideally with a lower drawdown. These days, there are plenty of low cost ways to invest in an NIFTY 50 index fund – so why should someone invest in a more expensive active MF if it can’t beat the index?

Let’s then look at the data to figure out the best options. If we take the year ending July 2022, hardly any funds have beaten the index. Nippon India Large Cap Fund has beaten the index, a rare exception, but it underperforms when we look at a 3 year or 5 year timeframe. So there is an issue with consistency.

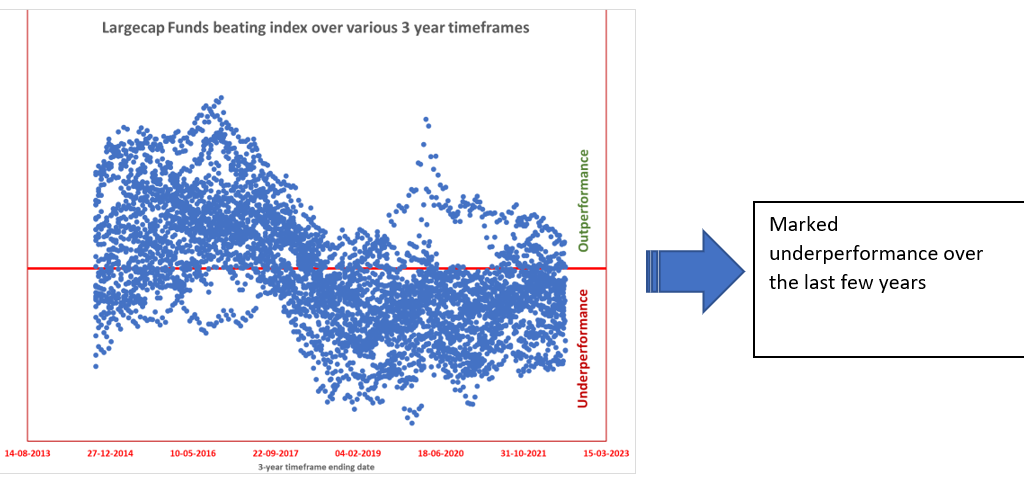

To address both performance and consistency – we evaluated various large cap funds over the course of multiple 3-year timeframes (we defined each 3-year timeframe separated by 2 weeks).

For example, the performance of Nippon Large Cap Fund over a 3 year period ending 29th July 2022 is a datapoint. While the performance over a 3-year period ending 15th July 2022 is another data point. A good fund will beat the index over a substantial number of these timeframes.

Let’s see what the data reveals.

Each dot represents a fund performance over a specific 3-year timeframe. The red line in the center represents index performance – an investor can, and should, aspire to that level of performance.

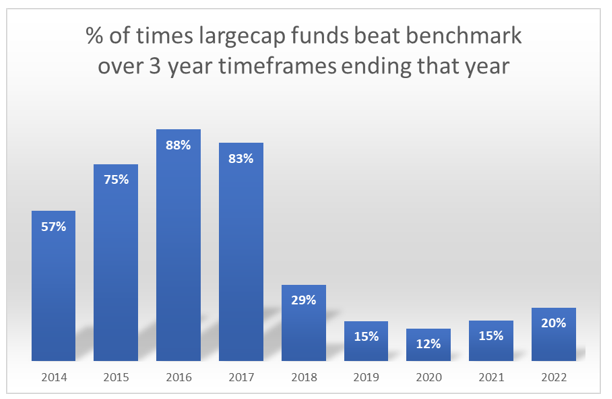

If we dig down into specific numbers, we see that large cap funds have only beaten the index about 20% of the time this year. And we don’t think that’s enough justification for investing in an actively managed large cap fund.

However, if one is interested in having an actively managed large cap fund in their portfolio, there are funds that have done reasonably well historically. These include funds that have beaten the index fairly often this year too (on a 3-year timeframe, rather than a 1-year timeframe which is too short for comparison). These are – Canara Robeco Bluechip, ICICI Prudential Bluechip, Kotak Bluechip, Axis Bluechip, SBI Bluechip, Nippon India Largecap, and Mirae Asset Largecap fund. But only a couple of them have been performing consistently if we consider the more recent timeframes.

How are we using data to provide some objectivity regarding evaluation of MF performance?

When we evaluate mutual funds, we look at 3 core factors to guide us.

- Has the fund outperformed it’s benchmark over time?

- Does the fund show consistency in its performance?

- Has the fund managed to reduce the extent of drawdowns historically?

While the extent of outperformance is very important, one also needs to select funds that tend to be less erratic (or less volatile in nature). That is the reason we recommend investing in funds that are steady outperformers, while also protecting your money to the best extent possible when the markets go down.